May 6, 2025 App Development

Insurance Mobile App Development: Cost, Benefits, Features, and Types

May 6, 2025 App Development

Table of Contents

May 6, 2025 App Development

With the emerging technologies like AI, ML, and big data analytics, the insurance app market is undergoing a huge transformation. While technology stands at the forefront of everything, the insurance companies are no longer exceptions in the race to adopt it.

According to the reports, the global insurance market will make a revenue of $8.4 trillion by 2026 and making it one of the leading players in the digital space.

In fact, 50% of insurance searches are performed on mobile devices.

On the positive side, the outcome of digital transformation has led many startups and insurance companies to invest in developing insurance apps.

These numbers convey that even clients are looking for insurance apps or tech-based products before they make a final decision. Utilizing modern apps for insurance can help you grow your business faster, making stronger connections and boosting the client satisfaction rate.

In this digital age, insurance app development is no longer an extraordinary thing for the industry, it is an urgent need to stay ahead of the competition. Today, clients are more interested in approaching insurance companies that offer smooth access, convenience, real-time availability of information, and 24/7 support for queries.

This is where, if you’re looking to expand your insurance business or planning to venture into the insurance market, then developing a top-notch app for your insurance business will be a worthy decision.

Here we have a complete guide to insurance mobile app development, explaining all the features, types, and so on.

While talking about insurance policies, you will start connecting it with the traditional process of accessing documents, lots of paperwork, and the slow manual procedure of accessing the policies.

But in the fast-paced world, where customers now expect instant access, personalized experiences, and seamless interactions, traditional insurance processes are no longer meeting the mark. This is where insurance mobile app development services are play a key role and allow businesses to embrace this digital transformation.

By developing a custom app for insurance, you can improve customer engagement, streamline operations, and create more intelligent, data-driven services. These apps aren’t just digital tools, they’re strategic assets in helping insurers stay relevant and competitive in a digital-first era.

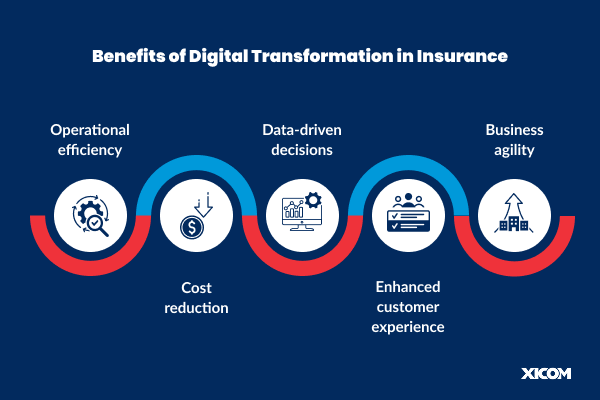

Before you jump straight to hiring software developers, it is worth understanding the benefits of developing an app for the insurance business and how it helps them maintain quick and easy communication with their clients.

The well-planned insurance app can eliminate all the paperwork and automate the tedious manual processes. Even business leaders have acknowledged the need for custom insurance mobile app development. If you are ready to venture into the insurance app market, then let’s review the benefits of these apps for the insurance business and their clients.

The modern age clients quickly fall for a smooth digital experience while interacting with their insurance. Also, they look for content to be readily available and easy to access. Moreover, clients value the transparency that you offer through an app.

Apart, let’s look at the significant benefits of the insurance apps for clients:

Apps provide many advantages to insurance companies as well, such as simplifying the processes and minimizing operational expenses. Insurers can utilize these digital assets to quickly access the information of clients on the go.

Now you know how insurance apps are benefiting your business and clients, it’s time to find out which type of application you will need to succeed in this thriving industry.

There are various types of insurance categories and each app type is defined with different sets of functionalities and features depending upon the business’s niche. In general, the insurance domain is witnessing six major types of insurance app development services that further depend upon the types of services and financial protection you are offering.

The technology has overall improved the healthcare systems by improving efficiency, communication, cost, and quality of healthcare services. The convience of smartphones, especially in developed countries, has enabled healthcare providers to be more accessible through mHealth. According to Statista, 43% of the US population is using health apps in 2024, as it offers more personalized and patient-centric care.

If health insurance app development solution is your insurance app category, then you can provide the users with features including:

With a life insurance application, customers can manage and keep track of their policy. With this app type, the users can streamline their routine process, like:

Vehicle insurance or car insurance mobile app development services offer digital platforms where users who have been in an accident can claim their losses. These apps are designed to help users:

Property insurance apps are allowing property owners to insure their real estate, artwork, jewelry, and more. The app simplifies how users can:

Business Insurance apps can help users to protect their investments that they have made in different businesses by using various features in the app, including:

Make your travel journey secure and protected with a wide range of insurance services. If you are in a travel agency, then offering travel insurance services can be your concern. So here’s what users can avail of using an app:

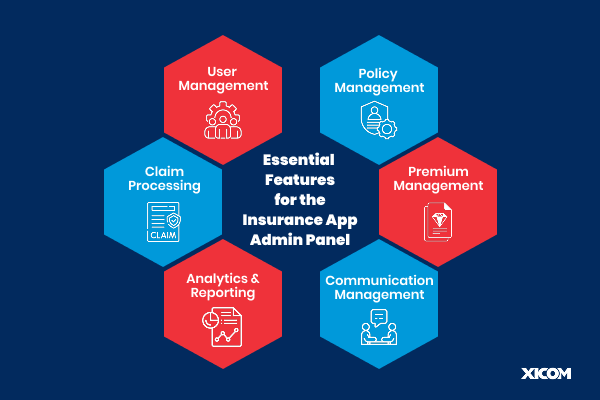

No matter what type of application you are trying to build for the insurance business, the success of the app refers to its features. So, while you are looking to hire a mobile app development company in India, make sure they help you integrate all the essential features.

Developing a mobile app is always an overwhelming task, but soon it can turn into a blunder if you are not prioritizing the features. During the insurance application development, you will encounter multiple variations of potential features to add to your custom mobile app.

But what are the features that make sense for most apps? Well, any software development company will help you prioritize it, but still, let’s take a look at them:

These are the basic features that most insurance mobile apps should have. But what if you are developing it for healthcare organizations? That said, your target audience may expect a few critical features depending on your chosen industry.

So, what certain features do you need to incorporate that serve the purpose?

For example, if you are looking for car insurance mobile app development, here are the major features that you need to offer in an app:

Similarly, what if you are developing a life-insurance application? In that case, hire a mobile app developer to integrate the following features:

So now these are the major features that can be varied depending upon business requirements, but how will you ensure a hassle-free workflow of insurance software applications?

Let’s take a sneak peek at the tech stacks required to create a custom insurance app…

No matter how brilliant the mobile app ideas you have to transform it into reality, they will be worthless if it has no downloads. This is where the importance of the development process chosen by your dedicated insurance app development company matters the most.

Though in this digital era, there are endless options to explore when it comes to choosing the best tech stacks. But here we have listed the best choice of tech stacks that ensure the app’s stability, scalability, and security.

| Category | Technology/Tool | Purpose |

| Frontend (Mobile) | React Native, Flutter, Swift (iOS), Kotlin (Android) | Cross-platform or native mobile app development |

| Backend | Node.js, Django, Ruby on Rails, Spring Boot | Server-side logic, APIs, and business logic |

| Database | PostgreSQL, MongoDB, MySQL, Firebase Realtime DB | Secure storage for policies, user data, and claims |

| Cloud & Hosting | AWS, Google Cloud, Microsoft Azure | Scalable hosting, storage, and CI/CD pipelines |

| Authentication | Firebase Auth, OAuth 2.0, JWT | Secure user login, identity verification |

| Payment Integration | Stripe, Razorpay, PayPal, Braintree | Handling premium payments and in-app transactions |

| Push Notifications | Firebase Cloud Messaging, OneSignal | Alerts for renewals, claim status, offers |

| Analytics & Reporting | Google Analytics, Mixpanel, Firebase Analytics | Track app performance, usage, and user behavior |

| Customer Support | Zendesk, Freshdesk, Twilio | In-app support via live chat, calls, or ticketing |

| Security & Encryption | SSL/TLS, AES-256 encryption, Two-Factor Authentication (2FA) | Ensure data protection, compliance, and user security |

| APIs/Integrations | RESTful APIs, SOAP, Telematics APIs, Third-party InsurTech APIs | Integrate with third-party services like accident detection or telematics |

| DevOps & Monitoring | Docker, Jenkins, Kubernetes, Prometheus, Sentry | Deployment automation, performance monitoring, and error tracking |

| AI/ML Capabilities | TensorFlow, OpenAI, IBM Watson | For risk assessment, fraud detection, and personalized policy suggestions |

These are the best choices of technologies that can make sure the app runs like a well-oiled machine, but to remain ahead of the market competition, it is worth using the top technology trends…

So, what top technology trends can you incorporate in insurance app development?

The general estimation of the insurance mobile app development cost varies between $30,000 to $40,000 and can go above $50,000+.

There are multiple factors that impact the average mobile app development cost. It includes locations of the app developers, tech stack, the feature list, U/UX design, QA of the app, and more.

In other words, a simple app design with basic features and functionalities would take less development time and cost you less in comparison to an app with complex functionalities.

To give you a precise idea about the app development cost, here we have categorized the app development cost:

| Type of App | Estimated Cost Range | Timeline |

| Basic App | $20,000 – $30,000+ | 2 – 3 months |

| Mid-Level App | $30,000 – $40,000+ | 4 – 6 months |

| Advanced App | $50,000 – $100,000+ | 6 – 10+ months |

So now you have an idea about how much it costs to create an insurance mobile app. But before you proceed further, let’s take a note on the process of insurance app development!

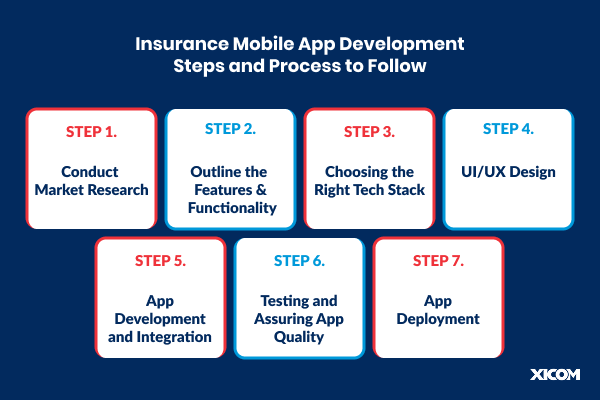

Creating an insurance mobile app involves a strategic blend of domain knowledge, user experience design, and robust tech implementation. Even if you are trying to get an app developed from the experts, you still need to understand what exactly goes into the app development process…

Begin the process by conducting a thorough market research where you need to analyze the user expectations and what competitors are offering.

To make sure that there is a demand for your app, identify the pain points users face while interacting with insurance providers and define your app’s unique value proposition.

Collect the requirements from all stakeholders, including agents, policyholders, and regulators, to understand the need to launch an app.

The choice of features and functionalities that you integrated into the app will quickly increase your budget. So, prioritize your app features based on the research and ensure a satisfying experience for the users. Here are the common features that you can consider for insurance app development:

Select technologies that offer scalability, security, and performance. Depending upon your goals, here you can pick the best choice of the technologies for:

Design an intuitive and user-friendly interface and ensure easy navigation in the app. Insurance apps must be engaging while being able to convey complex information. Use minimalistic design, have clear CTA buttons, and use simple layouts to improve user experience.

To create an insurance app, you need to hire a software development company that offers a complete team consisting of a project manager, backend/frontend developers, UI/UX designers, QA engineers, and more.

Make sure they use agile methodology for app development and ensure seamless integration with:

Conduct a rigorous app testing where experts test an app for functionalities, performance and security. Special focus should be given to data protection and must be compliance to HIPAA, GDPR and more.

Once the app is developed and being tested thoroughly, deploy it to the app stores (Google Play and Apple App Store). Ensure your app is being optimized for both platforms, meeting the app store guidelines and including clear descriptions and screenshots.

Transform your insurance business with smart insurance apps developed by the skilled team of Xicom. Xicom, a leading mobile app development company recognized for developing creative and effective insurance apps, can help you discover the full potential of your insurance business.

Our team of professionals designs and creates specialized insurance apps suited to your particular demands by combining the best industry-knowledge and technology. Using our user-centered insurance app, you can increase client interactions, streamline policy management, and boost revenue generation possibilities.

At Xicom, our simple aim is to empower businesses with scalable, secure, and seamless insurance applications, including healthcare insurance app development that surpasses industry standards.

Mobile apps have become a critical digital asset for businesses today. It not only helps you stay connected with the users but also enables you to expand your services with the evolving user demands.

So, if you are planning to develop a successful insurance app that caters to the modern needs of users, then it is worth hiring dedicated developer who guides you through a perfect app development strategy and ensures end-to-end solutions. In fact, they make sure that your app is professional enough to guide your clients from buying a new policy to renewing it to processing the claim.

Xicom is one such leading insurance app development company, working with a dedicated team of app developers, who can help you transform your app idea into reality by incorporating the best choice of features.

Here we have gathered additional information related to the insurance mobile app development that enables you to better understand the concept.

Investing in mobile app development allows insurance companies to digitize their services, improve customer engagement, and reduce operational costs. With real-time access to policy management, claims filing, and support, insurance companies to deliver a satisfied user experience and increase business efficiency.

The cost of developing an insurance app depends on various factors such as design complexity, number of features, operating platform choice, location of the development team, and more. A basic app may cost around $20,000 to $40,000+, while a feature-rich, enterprise-level app can exceed $50,000+.

Integrating AI and ML capabilities into insurance app solutiosn can help you drive smart insights of user behaviour, enabling risk assessment, detecting fraud and automate the claim process. These technologies can help insurers make data-driven decisions and deliver a more personalized user experience.

Data security is critical in insurance apps due to sensitive user data. Developers should implement strong measures like two-factors authentication, biometric login, end-to-end encruption and conduct regular security audits to ensure data protection.

The timeline of creating an insurance mobile app varies based on the features, designs, complexity and development team size. A basic app can be completed in 3-5 months, whereas a fully-featured scalable app with advanced functionality may take 8 to 12 months.