Jun 25, 2025 App Development

Mobile Banking App Development: What Users Expect Today for a Successful Mobile Banking App

Jun 25, 2025 App Development

Table of Contents

Jun 25, 2025 App Development

Remember, when you first installed a mobile banking app, it was to check your bank balance? Those days are long gone.

The current generation of mobile banking apps is packed with powerful features. Banks are constantly transforming their online presence to stay ahead of the competition.

Millennials often struggle to manage their finances or save money. As a result, they often switch to these apps in search of assistance. Additionally, today banks are judged of their progress and growth with their ability to serve their customers beyond borders and time zones.

This makes it crucial for banks to have a mobile banking app.

Before we delve into understanding the must-have features to integrate with mobile banking app development, let’s first define what a mobile app is, its necessity, and take a look at the current online banking market.

A mobile banking software is an online access to your bank account. It allows you to access your information at any time conveniently. Additionally, it makes financial transactions effortless and efficient.

Consider it a mini bank branch in your pocket, offering convenience and round-the-clock access to your finances. Currently, there are multiple banking apps, such as Chime and N26, that empower users to manage their finances independently.

Listed below are some of the key uses of a banking application:

Banking apps have successfully transformed the way users interact with and manage their finances. Users can now manage everything on the go, whether paying bills, managing investments, or tracking expenses, all faster, easier, and securely.

There is no doubt that the mobile banking software adoption has skyrocketed in the past decade. Customers are now demanding secure, feature-rich, and fast applications for their banking needs.

Let us now examine the reports’ findings regarding the numbers.

In the current world, an intuitive banking app is crucial for a business’s success. What makes an app stand out, you ask? Its features! The features of an app determine its success in today’s competitive landscape.

For an intuitive, immersive, and unique banking app development, consider the following features.

It is a key and foundational feature required while processing mobile banking software development. It enables users to check their account balance, transaction history, passbook, and download data to better understand their finances, or even share it with financial advisors.

Security is crucial for any mobile banking app. Especially, in today’s time, when breaches, data theft, and fraud have become a huge bottleneck for industries, considering a secure transaction system, leveraging blockchain technology, will help banking institutions to instill trust among their users.

Tools like:

What is a banking app without the feature to transfer funds?

Whether a user wants to transfer funds between their accounts or to other bank accounts, they should be able to do so effortlessly within the app.

Moreover, an app should also support additional features of bill payments, payment scheduling, etc. to make it convenient for customers to manage their finances. This improves their retention on the app and grows your business in the long term.

The primary purpose of a mobile banking app is to enable convenience and reduce the need for users to visit branch offices. This is where the mobile deposit feature, also known as Remote Deposit Capture, enabled with AI, helps users to deposit checks using their smartphone cameras. It is a secure and convenient alternative to rushing to the bank each time for cheque deposits.

When choosing a bank or switching to an online banking application, users appreciate an app that goes the extra mile to empower them financially. Integrating thoughtful tools for budgeting, market insights, and finance categorization will help users manage their finances better.

Additionally, it will provide them with clarity on their finances, savings, and expenses, enabling them to manage their money more effectively.

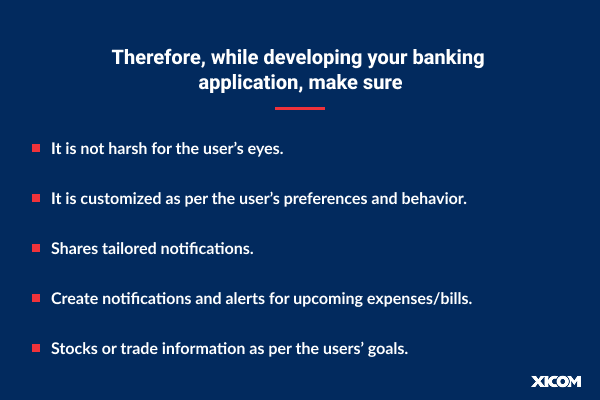

Creating a user-friendly application which is customized and tailored to one’s needs is a call of the hour currently. Creating user-friendly online banking apps can act as a key feature in helping your bank stand out from the competition.

Notifications and in-app alerts are crucial for a banking app as they provide users with instant updates on information vital to them. This is also the reason why notifications are considered a key feature in a mobile banking application.

With this feature, users can set up alerts for their transactions. This will also help them quickly detect unusual activities and raise concerns.

Additionally, users can set reminders for low balances, upcoming bills, pending transactions, and more to stay updated and avoid penalties. If you still don’t have it, hire software developers and get this feature added as this will further attract customers, increase engagement, and boost retention.

Tracking a credit score is an absolute necessity for all. Therefore, integrating a credit score during banking apps development will create a strong foundation for your online venture. It will enhance both the user experience and the overall financial well-being.

Integrating a credit score tool into a bank app is a crucial feature that enhances both user experience and financial well-being. This provides users with real-time access to their credit score and offers insight into factors that affect it, including payment history, credit utilization, and credit inquiries.

This openness enables users to make informed financial decisions and promotes responsible credit behavior. For banks, a powerful commitment is essential to create trust and loyalty, as users are more likely to interact with apps that offer personalized, valued services.

In addition, it opens strategic opportunities for cross-selling by identifying customers who are qualified for debt, credit card, or refinancing, allowing banks to offer pre-approved products.

By promoting financial literacy and credit health, the tool also helps to reduce default rates and improve risk management. In a rapidly competitive digital banking scenario, a built-in credit score feature not only separates the app but also aligns with the growing demand for innovative, self-service financial tools.

Integration with third-party services is a primary function of modern banking applications, as it increases functionality, flexibility, and user experience significantly. By connecting reliable external platforms – such as payment ports, investment equipment, insurance providers, and credit bureaus -Banks can offer a wide range of services in a single app ecosystem.

This allows users to pay bills, transfer money on platforms, use individual financial equipment, track their credit scores, and even invest or search for all loans without leaving the bank app. Such spontaneous integrations streamline operation, the user reduces friction, and the app increases engagement.

For banks, the new revenue streams open up, enabling rapid innovation and improving the customer experience by providing a comprehensive financial expertise. In addition, API (application programming interface) is used for this integration, ensuring safe, real-time data exchange while maintaining compliance with regulatory standards.

In an era where customers expect facilities, privatization, and speed, third-party service integration converts a standard banking app into a comprehensive financial center.

Finding a nearby branch or ATM is not just another feature of a mobile banking app. It is a necessary feature to add during banking app development. During times of absolute need, users should be able to locate nearby branches for quick access. Therefore, enabling locators will facilitate direct access for users, saving them the hassle of searching for one.

By offering such features in the app, you will be able to engage users who love convenience and attain a stronger market position. It is more likely to integrate branch or ATM locator features into your app to increase customer satisfaction and retention.

These advanced accounts are outside the basic features of the Insight Mobile Banking app.

These fintech apps provide users with deep understanding of their financial activity and consumption habits, enabling them to take control of their finances.

It can even analyze user expenditure habits according to your story and predict their upcoming bills based on member services or any seasonal expenditure patterns, helping you plan for the future.

Additionally, the app may benefit from AIS Kraft to categorize your shopping into subcategories, such as grocery items, dairy, and more.

It gives more granular views on consumable habits. So yes, it can do miracles for your app. However, to access advanced facilities, you must overcome the challenges of developing as a specialist.

Today’s time is about taking advantage of the powerful banking trend “Artificial Intelligence” to change the budget on a simple journey.

AI helps analyze transactions and identify any real-time scams, and wonder why users are blocking potentially suspicious transactions.

Utilizing AI development can enhance the security of bank apps, ultimately benefiting users. Anyone can enable users to establish automatic transfers based on predefined rules, such as saving a percentage of each paycheck.

In addition, AI can help you automate regular tasks such as bill paying or transmitting money, resulting in reduced human error and avoiding late fees.

Chatbots are crucial for providing users with a spontaneous and engaging experience.

One of the most significant benefits of a Chatbot is that it creates a human-like interaction and can copy the conversation of a customer support specialist.

In addition, unlike human assistant employees, these chatbots can operate 24/7, providing users with quick help at any time.

This eliminates waiting time and helps users get experts as soon as possible. This may impact your total costs for creating mobile banking apps, but it will significantly enhance the user experience with your app.

Another most advanced online banking system is “QR Code Payment”.

Since technology moves at a rapid pace, traditional payment methods, such as physical cards or mobile payment techniques like NFC, require ongoing work.

However, this is not the case with QR codes, as they are simple and can be scanned with the camera of some smartphones, eliminating the need for extra hardware.

The integration of this feature can offer a user-friendly and secure payment system that attracts users who prefer contactless payments, especially the younger generation.

Additionally, this hand will encourage your users to use even more applications, leading to higher user engagement.

With this, we hope that you will get ideas about how basic and advanced features can seriously change the landscape of your app. If you are ready to translate these ideas into action, and want to know how much it will cost you to build a mobile banking app, find it here.

As the market transforms, user needs change, and competition rises, are you still looking for reasons to develop a mobile banking app?

Let us get some facts straight to help you solidify your decision.

The increase in mobile banking app usage presents a golden opportunity for businesses. Therefore, if you are considering making an exceptional mobile banking app, this is the right time to take advantage of the booming market. Do your thorough market research or use this blog as a guide to find and hire mobile app developers in India.

Xicom Technologies is a leading mobile app development company in India, providing Android and custom iOS app development services to the finance industry. With our expertise in seasoned AI and blockchain developers, we specialize in building intuitive, secure, scalable, and customizable apps tailored to your business needs.

If you are looking for guidance on how to create a mobile banking app or considering hiring Android app developers, connect with our experts to have an app developed for your business exactly as you have envisioned it. Get in touch with us now!

The mobile banking scenario undergoes a dramatic change, shifting from a single tool to check the remaining amount at a comprehensive financial management center.

For banks and financial institutions, functional mobile banking apps are no longer an alternative; this is a standard for survival in today’s competitive market.

This blog post highlights both essential and advanced features that can enhance your mobile banking experience, strengthen user engagement, and boost overall engagement. By incorporating features such as secure transactions, budgeting tools, and AI-driven insights, you can develop a bank app that positions you as a reliable financial partner for your users.

Remember that the key to success lies in leveraging state-of-the-art technology to understand the user’s needs and provide a seamless and secure banking experience.

To build an intuitive, immersive, and engaging mobile banking app, hire mobile app developers to bring your vision to life seamlessly.

A mobile banking software is an online access to your bank account. It allows you to access your information at any time conveniently. Additionally, it makes financial transactions effortless and efficient.

Consider it a mini bank branch in your pocket, offering convenience and round-the-clock access to your finances. Currently, there are multiple banking apps, such as Chime and N26, that empower users to manage their finances independently.

Here is a list of features crucial in mobile banking app development:

– Account Management

– Secure Transactions

– A system to transfer funds

– Mobile deposits

– In-app budgeting tools

– User-friendly application

– Notifications and in-app alerts

– Integrate a credit score tool

– Third-party integration

– Branch or ATM Locator

– Advanced account settings for deeper insight

– AI-enabled Insights

– Integrating AI chatbots

– Integrating QR codes for payment

Xicom Technologies is a leading software and mobile app development company in India, offering seamless hiring of software developers to build your banking application. With our expertise in seasoned AI and blockchain developers, we specialize in creating intuitive, secure, scalable, and customizable apps tailored to your business needs.

To boost user engagement and retention, banks can transform their applications into user-centric and intelligent financial hubs. Start by offering an intuitive and seamless user interface, easy navigation, and clear access to key features such as account balance, transfer history, and bill payments.

Characteristics such as credit score tracking, budgeting equipment, and target-based savings schemes help users control their finances and increase the stickiness of the app. Information for payment reminders, individual offers, or financial tips is provided and related to users. In addition, integrating lifestyle services— such as investment platforms, insurance options, loyalty programs, and frequent use —can enhance the overall experience.

Security also plays an important role, including biometric authentication, instant fraud alerts, 24/7 support, Trust, and long-term loyalty. Gamification elements, such as milestones or a financial quiz to save, may increase further calls.

Finally, when a bank app goes beyond transactions to provide a meaningful, personal experience, it becomes a valuable everyday tool – the customer relationship that separates and continues commitment and storage.